Value-added-tax rate increases: A comparative study using difference-in- difference with an ARIMA modeling approach | Humanities and Social Sciences Communications

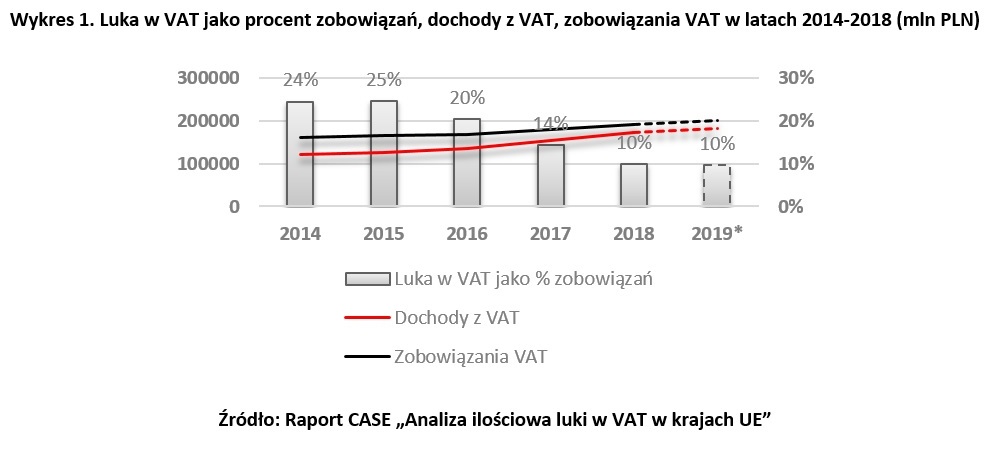

Luka w VAT w Polsce może wzrosnąć do 14,5% w 2020 r. - CASE - Center for Social and Economic Research